Introduction

|

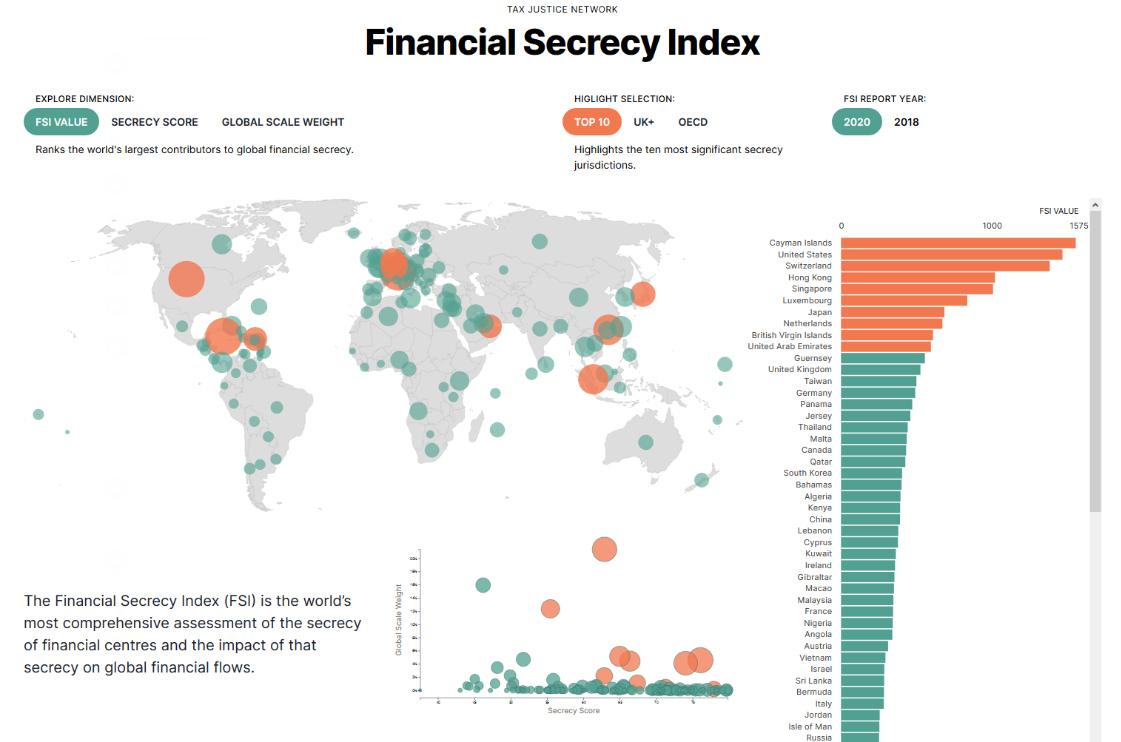

The Financial Secrecy Index ranks jurisdictions according to their secrecy and the scale of their offshore financial activities. A politically neutral ranking, it is a tool for understanding global financial secrecy, tax havens or secrecy jurisdictions, and illicit financial flows or capital flight. The index was launched on 18 February 2020. The Financial Secrecy Index complements our Corporate Tax Haven Index, which ranks the world’s most important tax havens for multinational companies. The menu on the left provides more information on how the index works, and provides context. |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

|

Shining light into dark places An estimated US$21 to $32 trillion of private financial wealth is located, untaxed or lightly taxed, in secrecy jurisdictions around the world. Secrecy jurisdictions – a term we often use as an alternative to the more widely used term tax havens – use secrecy to attract illicit and illegitimate or abusive financial flows. Illicit cross-border financial flows have been estimated at US$1-1.6 trillion per year, dwarfing the US$135 billion or so in global foreign aid. Since the 1970s, African countries alone have lost over US$1 trillion in capital flight, while combined external debts are less than US$200 billion. So Africa is a major net creditor to the world – but its assets are in the hands of a wealthy elite, protected by offshore secrecy; while its debts are shouldered by broad African populations. Rich countries do not go unscathed. For example, European countries like Greece, Italy and Portugal have been brought to their knees partly by decades of tax evasion and state looting through offshore secrecy. A global industry has developed involving the world's biggest banks, law practices, accounting firms and specialist providers who design and market secretive offshore structures for their tax- and law-dodging clients. “Competition” between jurisdictions to provide secrecy facilities has become a central feature of global financial markets, particularly since the era of financial globalisation really took off in the 1980s. The problems go far beyond tax. In providing secrecy, the offshore world corrupts and distorts markets and investments, shaping them in ways that have nothing to do with efficiency. The secrecy world creates a criminogenic hothouse for multiple evils including fraud, tax cheating, escape from financial regulations, embezzlement, insider dealing, bribery, money laundering, and plenty more. It provides multiple ways for insiders to extract wealth at the expense of societies, creating political impunity and undermining the healthy ”no taxation without representation” bargain that has underpinned the growth of accountable modern nation states. Many poorer countries, deprived of tax and haemorrhaging capital into secrecy jurisdictions, rely on foreign aid handouts. This hurts citizens of rich and poor countries alike. What is the significance of this index? In identifying the most important providers of international financial secrecy, the Financial Secrecy Index reveals that traditional stereotypes of tax havens are misconceived. The world’s most important providers of financial secrecy harbouring looted assets are mostly not small, palm-fringed islands as many suppose, but some of the world’s biggest and wealthiest countries. Rich OECD member countries and their satellites are the main recipients of or conduits for these illicit flows. The implications for global power politics are clearly enormous, and help explain why for so many years international efforts to crack down on tax havens and financial secrecy were so ineffective, it is the recipients of these gigantic inflows that set the rules of the game. Yet our analysis also reveals that recently things have genuinely started to improve. The global financial crisis and ensuing economic crisis, combined with recent activism and exposure of these problems by civil society actors and the media, and rising concerns about inequality in many countries, have created a set of political conditions unparalleled in history. The world's politicians have been forced to take notice of tax havens. The sweeping reforms that were made in recent years and have led to a global curbing of financial secrecy were considered to be impossible to achieve when the first Financial Secrecy Index was published a decade ago. The Financial Secrecy Index 2020 shows that the biggest reforms have been in automatic exchange of information and beneficial ownership registration, whereas reforms in country by country reporting have been weak. These three areas of reform, also known as the “ABCs” of tax justice, have gained the most attention from campaigners, tax experts and policymakers in recent years. Progress on country by country reporting remains slow, leaving unchecked the rampant tax abuse that disproportionally undercuts the people who start out with less opportunities in life to begin with. Women, minorities and disabled people are more likely to pay the price of the bill left behind by tax abusers and be locked out of leading a meaningful and fulfilling life. The OECD currently has a once-in-a-century opportunity to reform an international tax system that has allowed financial secrecy to flourish. The only realistic way to address these problems comprehensively is to tackle them at root: by directly confronting offshore secrecy and the global infrastructure that creates it. A first step towards this goal is to identify as accurately as possible the jurisdictions that make it their business to provide offshore secrecy. This is what the Financial Secrecy Index does. It is the product of years of detailed research by a dedicated team, and there is nothing else like it out there. We also have a set of unique reports outlining detailed offshore histories of the biggest players in the game. Click here for the full 2020 ranking. For further questions, click here. Commercial users must purchase a licence to use any Financial Secrecy Index data. All users must register to access data in Excel format (registration is free for non-commercial users). |

|

|||||||||||||||||||||||||||||||||||||