What is financial secrecy?

Financial secrecy occurs when there is a refusal to share financial information with legitimate authorities, such as, tax authorities and police services. We are exercised with cross-border financial secrecy, of the kind created by secrecy jurisdictions.

Financial secrecy is different from legitimate confidentiality. It is entirely legitimate for a bank to keep your details confidential.

There are three types of cross-border financial secrecy.

Bank secrecy – Bankers promise to take their clients’ secrets to the grave, and criminal penalties often apply to those who break the secrecy.

Corporate secrecy – This is where jurisdictions allow the creation of legal entities and arrangements but permit ownership, accounts, and purpose to be kept secret, and sometimes where the very legal basis of ownership becomes muddied. These arrangements may be trusts, corporations, foundations, anstalt, or others. Such secretive structures can provide a firewall between an asset and its owner. If an asset, such as a property, is held by an offshore company which does not publish its owners, the ownership of the property is also concealed. In some secrecy jurisdictions, almost no information is available about companies established under their jurisdiction. Secrecy provided through an offshore trust can be even harder to break than bank secrecy (read more about trusts here.)

Non-cooperation – This relies on jurisdictions putting up barriers to co-operation and information exchange. This may be through refusing to exchange information, or deliberately refusing to pursue and collect information held locally.

The Financial Secrecy Index is the first ever comprehensive global effort to identify all the different mechanisms of financial secrecy, and weigh them in importance. Our approach emphasises the existence of a ‘secrecy spectrum’: the question of whether a jurisdiction is or isn't a secrecy jurisdiction is generally one of degree.

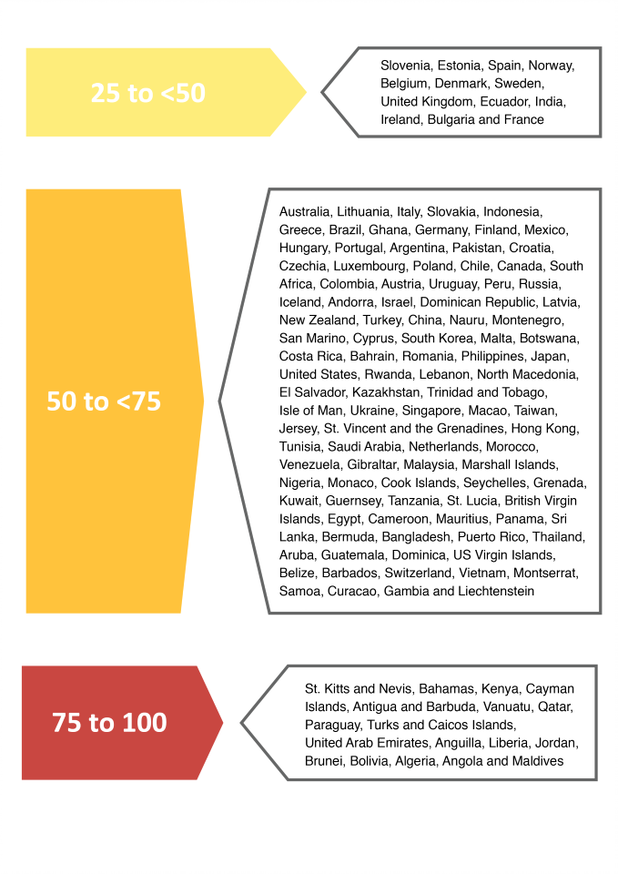

The chart below strips out the weighting from the Financial Secrecy Index and focuses purely on the secrecy score, revealing how the 133 jurisdictions are distributed across the secrecy spectrum. They range from exceptionally secretive (the Maldives and Angola, indicated by the red bar), to moderately secretive (Estonia and Slovenia, indicated by the yellow bar). Clearly much more needs to be done to tackle this global scourge. (Click here for our ranking by secrecy score only.)