What is financial secrecy?

Financial secrecy occurs when there is a refusal to share financial information with legitimate authorities - for example, tax authorities and police authorities. We are exercised with cross-border financial secrecy, of the kind created by tax havens or secrecy jurisdictions.

Financial secrecy is different from legitimate confidentiality. It is entirely legitimate for a bank to keep your details confidential.

There are three types of Cross-border financial secrecy.

Bank secrecy - Bankers promise to take their clients’ secrets to the grave, and criminal penalties often apply to those who break the secrecy.

Corporate secrecy - This is where jurisdictions allow the creation of legal entities and arrangements – whether trusts, corporations, foundations, anstalts or others – whose ownership, accounts, and purpose is kept secret, and sometimes where the very legal basis of ownership becomes muddied.

These structures can provide a firewall between an asset and its owner. If an asset, such as a property, is held by an offshore company which does not publish who owns it, the ownership of the property is also concealed. In some tax havens almost no information is available on companies established under their jurisdiction.

Secrecy provided through an offshore trust can be even harder to break than bank secrecy (read more about trusts here.)

Non-cooperation - this relies on jurisdictions putting up barriers to co-operation and information exchange. This may be through refusing to exchange information, or deliberately refusing to pursue and collect information held locally.

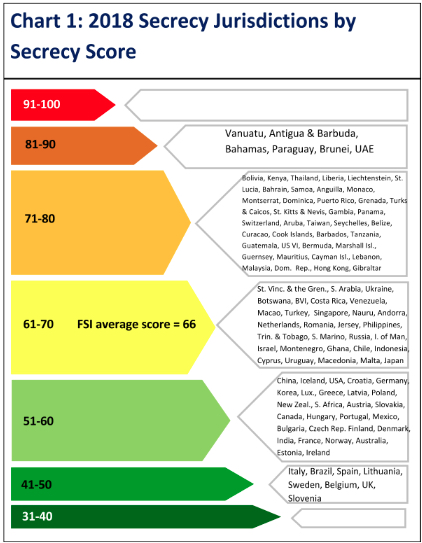

The FSI is the first ever comprehensive global effort to identify all the different mechanisms of financial secrecy, and weigh them in importance. Our approach emphasises the existence of a ‘secrecy spectrum’: the question of whether a jurisdiction is or isn't a secrecy jurisdiction is generally one of degree.

Chart 1 strips out the weighting from the FSI and focuses purely on the secrecy score, revealing how the 112 jurisdictions are distributed across the secrecy spectrum. They range from exceptionally secretive (Vanuatu and Antigua & Barbuda, indicated by the red bar), to moderately secretive (Italy and Brazil, indicated by the medium green bar). Clearly much more needs to be done to tackle this global scourge. (Click here for our ranking by secrecy score only.)

| Chart 1: KEY

The bars in this chart range between red indicating exceptionally secretive, to dark green indicating moderately secretive. |