What roles do the UK and USA play?

The British connection

Various OECD member states run satellite secrecy jurisdictions, but Britain’s network is by far the largest, accounting for between a third and a half of the global market in offshore financial services. Ten secrecy jurisdictions on our list are either British Crown Dependencies (Jersey, Guernsey, the Isle of Man) or British Overseas Territories (such as the Cayman Islands, British Virgin Islands or Bermuda). These places, the last official remnants of the British Empire, are supported and controlled by the UK, though they each have different political systems and a measure of political autonomy. Outside this group lie a series of are 15 British Commonwealth Realms and 53 British Commonwealth countries, which include some Overseas Territories but otherwise have a much looser relationship with the UK.

All these jurisdictions generally share British common law; deep financial penetration by British financial interests and enablers; they typically use British-styled offshore structures such as trusts; they usually have English as a first or second language; and most of them have their final court of appeal at the Privy Council in London: a legal bedrock that reassures investors and underpins their offshore industries.

The Queen is head of state in most of these territories and in the Crown Dependencies and Overseas Territories she appoints top officials including the governor; and her head appears on their stamps and banknotes. Britain has wide powers that allow it to disallow or change their secrecy legislation, though as our UK Narrative Report explains these powers are not straightforward, and Britain has generally chosen not to exercise its powers for political and economic reasons.

The British network has for decades served as a global 'spider's web' network capturing financial business from countries around the world and feeding it into the City of London. Jersey Finance, the official body representing that secrecy jurisdiction's financial services industry, illustrates this with a statement that "Jersey represents an extension of the City of London." This network, among many other things, allows the City to get involved in dubious financial businesses at arm's length, and to avoid responsibility when scandal strikes.

Has the UK cracked down?

The UK has made good progress in tackling domestic financial secrecy. For example, it has implemented a public register of beneficial ownership of companies. However, the British government still continues to protect the status of the overseas territories and crown dependencies - such as the Cayman Islands (#3) and the British Virgin Islands (#16) - where much of the dirty business is done before reaching the City of London.

Although there have been some attempts by the UK Parliament to impose registers of beneficial ownership on the overseas territories and crown dependencies, these efforts were halted by a surprise General Election in 2017. Another attempt to impose these rules though the legislature in 2018 failed when it was opposed by the government.

In recent years, the government of the UK refused to impose more financial transparency on these territories, especially with regard to trusts. To the contrary, it has actively protected them from international scrutiny, for example, by lobbying to remove them from the EU’s list of tax havens released in 2017.

And while, in September 2013, the former UK Prime Minister David Cameron stated in the House of Commons: "I do not think it is fair any longer to refer to any of the Overseas Territories or Crown Dependencies as tax havens. They have taken action to ensure that they have fair and open tax systems.", more than four years later little has changed.

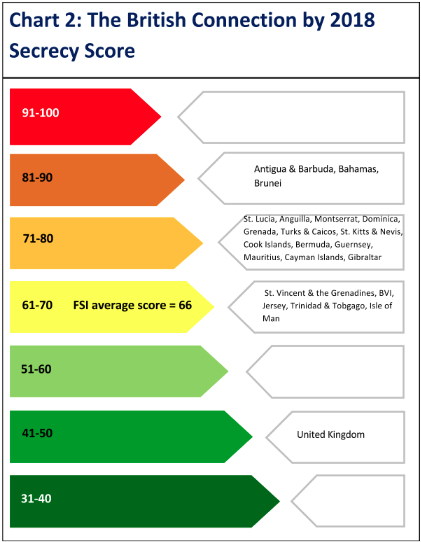

Table 1 and Chart 2 below illustrate how untrue this statement remains.

Table 1: Performance of British overseas territories, crown dependencies, by Key Financial Secrecy Indicators

(Each indicator is explained here).

|

* The secrecy score is the average score multiplied by 100 KEY

|

||||||

|

Chart 2 takes this point further, revealing that the British jurisdictions are clustered towards the top (more secretive) end of the secrecy spectrum, with the British Commonwealth countries of Brunei, Antigua and Barbuda, and Bahamas sharing the dubious distinction of being extremely secretive.

The United States

The United States, ranked in second place in our 2018 index, started deliberately turning itself into a secrecy jurisdiction during the Vietnam War, as a way of attracting capital to fill its expanding external deficits. As our USA special report explains, these secrecy facilities were deliberately constructed at a Federal level; and also individual states such as Delaware or Nevada offer powerful secrecy through corporate vehicles incorporated in those states.

Today the United States is perhaps the jurisdiction of greatest concern, in terms of global financial transparency.he US’ rise in the FSI 2018 rankings is part of a worrying trend. This is the second time in succession that the USA has risen up the Financial Secrecy Index. In 2013 the States was in 6th place, and in 2015 it took 3rd. In 2015 the country was one of the few to increase its secrecy score. This time the increase in ranking is driven by a huge rise in their share of the market in offshore financial services that wasn't neutralised by a significant reduction in their secrecy. In total, the share of global offshore financial services taken by the United States rose by 14% between the 2015 and 2018 index from 19.6% to 22.3%.

While the U.S. has taken major steps to protect itself against tax evasion via foreign tax havens -- not least through its willingness to arrest Swiss bankers and open up the Swiss secret banking establishment, and through its feisty Foreign Account Tax Compliance Act (FATCA,) to hunt down U.S. taxpayers' assets overseas. But it has been very reluctant to share information in the other direction: residents of other countries have stashed trillions of dollars' worth of assets in the U.S., secure in the knowledge that the U.S. refuses to take part in international initiatives to share tax information with other countries. Moreover, it has failed to end anonymous companies and trusts aggressively marketed by some US states. There is now real concern about the damage this promotion of illicit financial flows is doing to the global economy.

See more in our USA special report.

|